USA Cash App: A Comprehensive Guide for Users

The USA Cash App is a popular mobile payment service that has gained a significant following in recent years. Whether you’re looking to send money to friends, pay bills, or invest in stocks, the Cash App offers a range of features that cater to your financial needs. In this detailed guide, we’ll explore the various aspects of the Cash App, including its features, benefits, and how to use it effectively.

How Does the Cash App Work?

The Cash App is a mobile payment service that allows users to send, receive, and store money. To get started, you need to download the Cash App from the App Store or Google Play Store, create an account, and link a bank account or a debit card. Once your account is set up, you can use the app to perform a variety of financial transactions.

Here’s a brief overview of the key features of the Cash App:

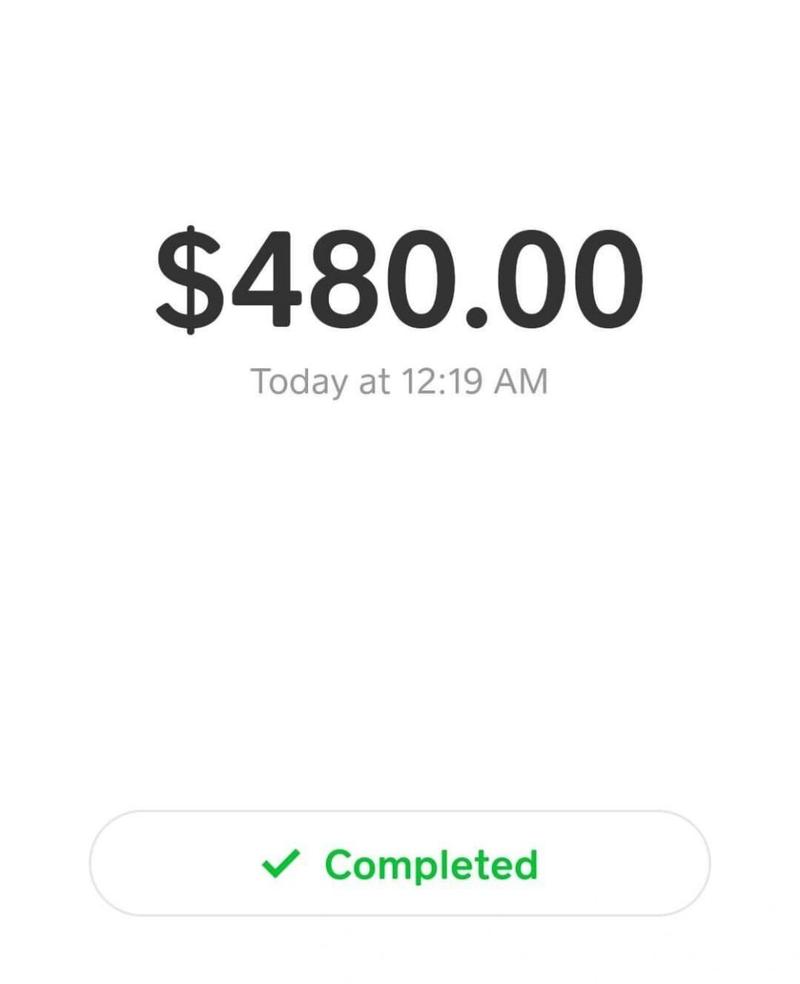

- Send and Receive Money: You can easily send money to friends or family members by entering their phone number or email address. Similarly, you can receive money from others using the same method.

- Pay Bills: The Cash App allows you to pay your bills directly from the app. You can set up automatic payments for recurring bills, such as rent, utilities, and credit card payments.

- Invest in Stocks: The Cash App offers a stock investment feature that allows you to buy and sell stocks, ETFs, and other assets. You can start investing with as little as $1.

- Buy Bitcoin: The Cash App also allows you to buy, sell, and store Bitcoin directly from the app.

- Accept Payments: You can use the Cash App to accept payments from customers or clients. Simply share your Cash App account information with them, and they can send you money directly.

Benefits of Using the Cash App

There are several benefits to using the Cash App, including:

- Convenience: The Cash App is easy to use and allows you to manage your finances on the go.

- Security: The Cash App uses advanced security measures to protect your financial information.

- Low Fees: The Cash App charges minimal fees for transactions, making it a cost-effective option for managing your finances.

- Investment Opportunities: The Cash App offers investment opportunities that can help you grow your money over time.

How to Use the Cash App

Using the Cash App is straightforward. Here’s a step-by-step guide to help you get started:

- Download the App: Download the Cash App from the App Store or Google Play Store.

- Sign Up: Create an account by entering your phone number and email address.

- Verify Your Identity: Verify your identity by providing your full name, date of birth, and the last four digits of your Social Security number.

- Link a Bank Account or Debit Card: Link a bank account or a debit card to your Cash App account to fund your transactions.

- Start Using the App: Once your account is set up, you can start sending, receiving, and paying bills using the Cash App.

Security and Privacy

Your security and privacy are important to the Cash App. Here are some of the measures the app takes to protect your information:

- End-to-End Encryption: The Cash App uses end-to-end encryption to protect your financial information during transmission.

- Two-Factor Authentication: You can enable two-factor authentication to add an extra layer of security to your account.

- Regular Security Updates: The Cash App regularly updates its security features to protect against new threats.

Customer Support

The Cash App offers customer support to help you with any issues you may encounter. You can contact customer support by:

- Email: Sending an email to support@cashapp.com.

- Phone: Calling the Cash App customer support at 1